What Happens to Your Assets When You File for Bankruptcy?

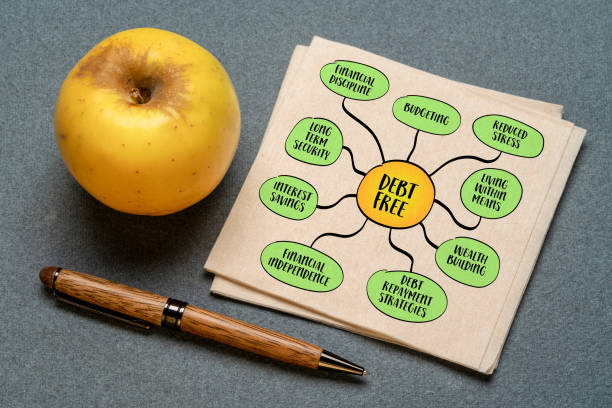

Filing for bankruptcy can provide financial relief for those burdened by overwhelming debt, but it often comes with questions and concerns about personal assets. Understanding what happens to your property, savings, and other possessions during the bankruptcy process is crucial to making an informed decision. This guide explores how bankruptcy affects your assets, what you…