ARE YOU STRUGGLING WITH DEBT?

WE ARE HERE TO HELP

ARE YOU STRUGGLING WITH DEBT?

WE ARE HERE TO HELP

We help individuals manage their debts through Individual Voluntary Arrangements (IVA) and Debt Management Plans (DMP). Both options provide a clear path to regain control of your finances and work toward stability.

We help individuals manage their debts through Individual Voluntary Arrangements (IVA) and Debt Management Plans (DMP). Both options provide a clear path to regain control of your finances and work toward stability.

Write off debts over £7,000

Stop interest and charges soaring

Reduce monthly payments to an affordable amount

- Write off debts over £7,000

- Stop interest and charges soaring

- Reduce monthly payments to an affordable amount

Get Started

Answer a few quick questions to check if you qualify to write off debt

Speak to our Agent

Chat to our Agent about your financial position

Leave it to us

Our Team will refer you to our FCA approved Firm to complete your IVA

How does it work?

If you’re dealing with unaffordable debt, you may qualify to reduce a portion of what you owe.

In the UK, residents have a legal right to debt relief, and several established solutions can help. These options not only provide ways to write off unsecured debt but can also ease creditor pressure and freeze interest and charges on included debts.

One effective solution is an Individual Voluntary Arrangement (IVA), which allows you to settle a percentage of your debt, making it a practical way to regain financial stability.

Write off most types of unsecured debt:

Credit Cards

Lines of Credit

loans

Overdrafts

Store Cards

Business Debt

Write off most types of unsecured debt:

Credit Cards

loans

Store Cards

Lines of Credit

Overdrafts

Business Debt

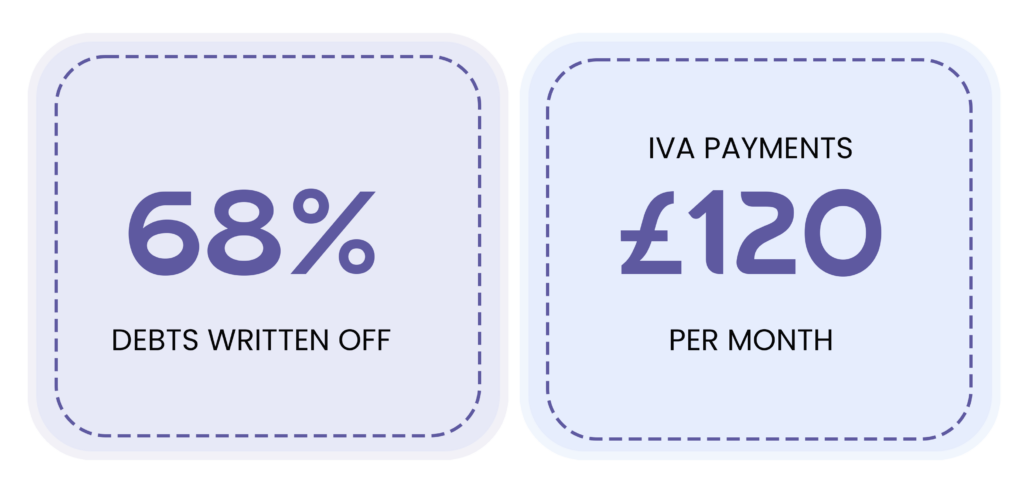

Here’s an example of how we can help

See how an IVA could help you with this simple example to consolidate debts into one smaller monthly payment and write off unaffordable debt.

Let's say you owe..

After an IVA

Monthly payments are based on individual financial circumstances

this is just for illustratration purposes only. Repayment calculated using income and expenditure data. Monthly payments and write off percentages are based on individual circumstances.

Was guided along very helpfully and managed to get my finances back under control and such a relief , thanks to everyone

Andrew smith

Overall debt has been reduced now and i can now pay my consolidated monthly figure , a win , win all round

Mark holden

Secured my house, avoided bankruptcy and on the way to a stable financial status

Kial branning

Frequently Asked Questions

Is an IVA suitable for me?

An IVA is a form of insolvency that allows you to write off debt and is an alternative to bankruptcy. It is available to eligible customers in England, Wales and Northern Ireland.

How does it work?

Our staff at “Apply for IVA” will make an initial fact-finding call which will explore all possible debt solutions applicable to you and whether these can be provided by our FCA Approved Firm.

If the criterea for IVA is suitable then our FCA Approved Firm will take over the case and review your cirecumstances.

If you live in England, Wales or Northern Ireland, an IVA may be a suitable debt solution.

If you live in Scotland, a Trust Deed or the Debt Arrangement Scheme may be a suitable debt solution. Trust Deeds and DAS will be provided by our FCA Approved Firm and fees will apply.

Can an IVA affect my credit rating?

Yes, an IVA will have a negative effect on your credit rating. It will also show on your credit report for six years after it has been approved.

Will entering an IVA affect my job?

In most cases entering an IVA won’t affect employment. However, in certain professions, such as accountants and solicitors, having an IVA may mean that you can no longer practice or you may only be able to practice under certain conditions.

Can creditors still contact me when I'm in an IVA?

Once you enter an IVA, creditors can take no further action against you and can’t contact you directly.

How can an IVA change my life?

An IVA can be a positive way to manage unaffordable debt and allow you to better manage your monthly finances.

In an IVA a single monthly payment is agreed with your current financial situation taken into consideration – this payment is then divided between the people you owe money to. During the course of your plan all interest and fees associated with your debts are frozen.

At the end of the IVA the remaining debts included in the arrangement are written off.

What are the advantages of an IVA?

It’s important to be aware of the advantages of an IVA when considering the best debt solution for your circumstances, such as:

- All creditors are bound by your IVA once approved.

- Creditors can’t take legal action against you in an IVA.

- Interest and charges on your debts are frozen by law.

- All IVA payments are based on what you can afford.

- Your IP will distribute payment to creditors on your behalf.

- You may get a payment break if your situation changes.

- You won’t have to sell your home in an IVA.

What are the disadvantages of an IVA?

When you’re considering entering an IVA, it’s important to be aware of the following:

- If you are a homeowner and your property has equity in it, you’ll need to try to re-mortgage which could result in an increased interest rate or a 12 month extension to your arrangement if you can’t remortgage.

- Your credit rating will be affected adversely.

- Only the unsecured debts included in your IVA will be written off at the end of the agreement.

- Your IVA will be recorded on a public register.

- If your IVA fails you could be at risk of bankruptcy.

- Your financial freedom might be restricted.

- Your creditors need to agree to the IVA.

What services do you offer?

We offer an initial fact finding call and refer suitable clients to our FCA Approved Firm who will offer debt advice tailored to your circumstances. They will find out more about your current financial situation and your lifestyle to advise on the best solution for you.

What fees apply?

Our Service + initial Call is free; however, we will recieve a referall fee should you decide to enter into an arrangement from our FCA Approved Firm.

What is the Insolvency Act 1986?

The Insolvency Act 1986 governs personal and corporate insolvency in the UK. The act covers issues related to bankruptcy, Individual Voluntary Arrangements and all administrative orders.

Important information

While “Apply for IVA “does not process IVA applications, we can assess your potential eligibility and, with your consent, refer you to a regulated debt management specialist who will discuss your options. Our service is free, as we receive compensation from the referred FCA-regulated firm. Your data will be managed in compliance with GDPR, and you may withdraw consent at any time or request deletion of your information at any time, by sending your request to dpo@applyforiva.co.uk

For details, see our privacy policy

About

Apply for IVA is a trading style of Riteway Claims Ltd

Company details

FRN: 941650

Address:

83 High Street

Hemel Hempstead

Hertfordshire

HP1 3AH

Tel: 0161 850 8411

Email: info@applyforiva.co.uk

ICO Ref ZA351745