Clear Unsecured Debt & Keep Assets with an IVA

If you’re struggling with unsecured debt and are worried about losing your assets, you’re not alone. Many people face similar challenges, but there is a solution: an Individual Voluntary Arrangement (IVA). This legal agreement between you and your creditors allows you to repay a portion of your debt over a set period while keeping control of your essential assets, such as your home and car.

In this blog, we’ll explore how an IVA works, how it can help clear unsecured debt, and why it’s a viable solution for Pensioners, Retirees, and UK citizens facing financial difficulties.

What is an IVA?

An Individual Voluntary Arrangement (IVA) is a formal, legally binding agreement between you and your creditors to pay off a portion of your unsecured debt over a period of typically five to six years. During this time, you make manageable monthly payments based on what you can afford. Any remaining eligible debt is written off at the end of the IVA, providing you with a fresh start.

How Does an IVA Help with Unsecured Debt?

Unsecured debt includes things like credit cards, personal loans, payday loans, and store cards. These types of debt can quickly accumulate and become overwhelming, making it difficult to stay on top of payments. If you have multiple creditors, managing these payments can feel like a never-ending struggle.

With an IVA, you can:

- Consolidate your unsecured debt: Instead of juggling payments to multiple creditors, you make a single, monthly payment to the insolvency practitioner (IP) overseeing your IVA. The IP distributes the funds to your creditors on your behalf.

- Freeze interest and charges: Once your IVA is approved, your creditors can no longer add interest or fees to your existing debt, which helps stop the cycle of growing debt.

- Write off a portion of your debt: At the end of the IVA, any remaining unsecured debt that’s eligible will be written off, giving you a clean slate to move forward.

The Advantage of Keeping Your Assets

One of the key benefits of an IVA is that it allows you to keep your assets, unlike other debt solutions like bankruptcy. Here’s how it works:

- Your home: If you own a property, you can usually keep it during an IVA. In some cases, you may be required to release equity from your home towards the end of your IVA, but this is not always necessary. If you can’t release equity, your IVA payments may be extended for up to 12 months instead.

- Your car: If your car is essential for work or daily life, you can typically keep it, as long as its value is reasonable. Your insolvency practitioner will assess the situation to ensure it aligns with your IVA terms.

Unlike bankruptcy, which can lead to the sale of assets to pay off debt, an IVA protects your home and essential assets, allowing you to maintain a level of financial stability.

Who Can Benefit from an IVA?

An IVA is a suitable solution for UK citizens facing significant unsecured debt, including:

- Pensioners: If you’re retired and living on a fixed income, managing debt can be especially challenging. An IVA can help you clear your unsecured debt without impacting your retirement savings or assets.

- Retirees: An IVA offers retirees a way to tackle debt while ensuring that their retirement income and lifestyle are protected.

To be eligible for an IVA, you generally need to:

- Have unsecured debt of at least £6,000.

- Be able to offer a regular monthly payment (typically at least £70).

- Be a resident in England, Wales, or Northern Ireland.

An insolvency practitioner will assess your financial situation to ensure an IVA is the best option for you.

The IVA Process: How Does it Work?

The IVA process involves several key steps:

- Initial Consultation: You discuss your financial situation with an insolvency practitioner (IP) to determine if an IVA is right for you.

- Proposal Creation: Your IP prepares a proposal outlining your repayment plan, which is submitted to your creditors.

- Creditors’ Meeting: Your creditors vote on whether to accept the IVA proposal. If at least 75% (by value) agree, the IVA is approved.

- Repayment Period: You make affordable monthly payments to your creditors for the agreed period (usually five to six years).

- Completion: At the end of the IVA, any remaining eligible unsecured debt is written off, and you are free from the burden of that debt.

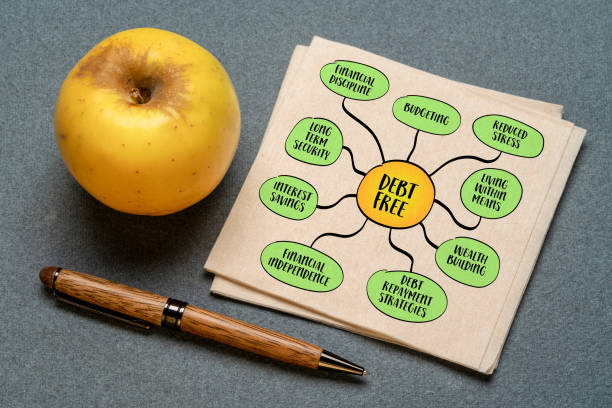

The Benefits of an IVA

An IVA offers several benefits, including:

- Debt Relief: Reduce and eliminate significant portions of your unsecured debt.

- Legal Protection: Creditors cannot take legal action against you once the IVA is in place.

- Manageable Repayments: A fixed, affordable repayment plan tailored to your financial circumstances.

- Asset Protection: You can usually keep your home and car, unlike with bankruptcy.

How We Can Help

At Apply for IVA, we specialize in helping UK citizens, including pensioners and retirees, tackle their unsecured debt through the IVA process. Our team of experts will guide you every step of the way to ensure that you get the best solution for your financial situation.

We’ll help you:

- Assess whether an IVA is right for you.

- Create a personalized repayment plan.

- Ensure that you understand your rights and obligations under the IVA.

- Protect your assets while clearing your debt.

Take Control of Your Debt Today

If you’re overwhelmed by unsecured debt and want to explore how an IVA can help you clear it without losing your assets, contact us for a free consultation today. We’re here to help you regain control of your finances and build a brighter future.

#IVADebtSolution #DebtFreeLife #UnsecuredDebt #FinancialFreedom #UKCitizens #Pensioners #Retirees #DebtRelief #IVA #BankruptcyAlternative #FinancialRecovery #AssetProtection